Pradhan Mantri Jan Dhan Yojana (PMJDY) – National Mission for Financial Inclusion – completes a decade of successful implementation

jatinnews.com August 28, 2024 0PM JD(S) brings the poor into the economic mainstream and plays an important role in the development of marginalised communities: Union Finance Minister Smt. Nirmala Sitharaman

The consensus-based pipeline by linking Jan Dhan-Mobile-Aadhaar is the most important pillar of the financial inclusion ecosystem – enabling speedy, seamless and transparent transfer of government welfare schemes to eligible beneficiaries and promoting digital payments: Smt. Sitharaman

PMJDY not only serves as an important example of governance in mission mode

PMJDY not only serves as an important example of governance in mission mode but also shows what the government can achieve if it is committed to the welfare of the people: Minister of State for Finance Shri Pankaj Chaudhary.Over 53.14 crore beneficiaries have been banked under PMJDY since its inception

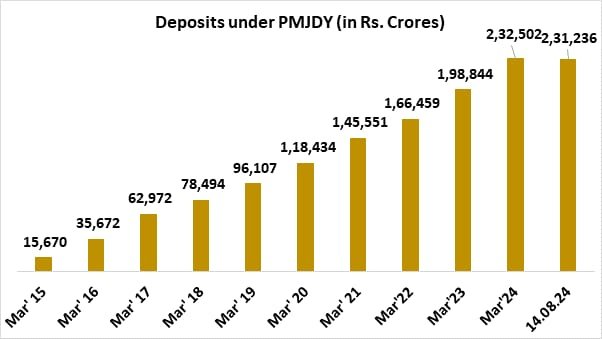

Total deposit balance under PMJDY account stands at Rs 2,31,236 crore

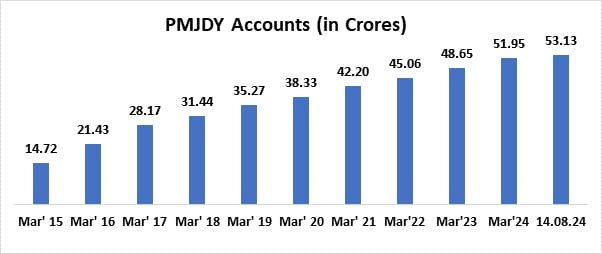

PMJDY accounts grew 3.6 times from Rs 15.67 crore in March 2015 to 53.14 crore by 14-08-2024

In rural and semi-urban areas, about 55.6% of Jan Dhan account holders are women and about 66.6% are Jan Dhan account holders

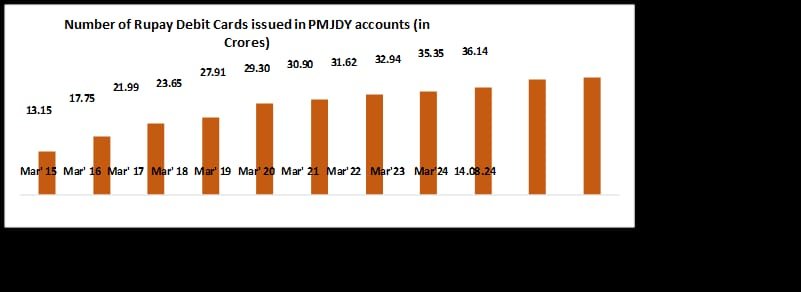

36.14 crore RuPay cards issued to PMJDY account holders.

Today marks the completion of a decade of successful implementation of the Pradhan Mantri Jan Dhan Yojana (PMJDY)

Today marks the completion of a decade of successful implementation of the Pradhan Mantri Jan Dhan Yojana (PMJDY), launched by the Prime Minister, Shri Narendra Modi, on 28th August 2014.

Since PMJDY is the largest financial inclusion initiative in the world, the Finance Ministry has been making constant efforts to provide support to the marginalised and economically backward classes through its financial inclusion interventions.

Speaking on the occasion, Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman said in a message

Speaking on the occasion, Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman said in a message, “Universal and affordable access to formal banking services is essential for achieving financial inclusion and empowerment. It plays an important role in the development of marginalised communities besides bringing the poor into the economic mainstream.

The Union Finance Minister said that the Pradhan Mantri Jan Dhan Yojana has transformed the banking and financial scenario of the country in the last decade by providing public, affordable and formal financial services including bank accounts, small savings schemes, insurance and loans.

The success of the move is reflected in the fact that 53 crore people have been brought into the formal banking system

The success of the move is reflected in the fact that 53 crore people have been brought into the formal banking system through the opening of Jan Dhan accounts. Deposits of Rs 2.3 lakh crore have been received in these bank accounts and as a result, more than 36 crore free RuPay cards have been issued, including an accident insurance cover of Rs 2 lakh. It is to be noted that there is no account opening fee or maintenance fee and there is no need to maintain a minimum balance.

“It is a matter of happiness that 67% of accounts have been opened in rural or semi-urban areas and 55% have been opened by women.

The Jan Dhan-Mobile-Aadhaar link is one of the most important pillars of the financial inclusion ecosystem

The consensus-based pipeline created through the Jan Dhan-Mobile-Aadhaar link is one of the most important pillars of the financial inclusion ecosystem. This has enabled faster, seamless and transparent transfer of government welfare schemes to eligible beneficiaries and encouraged digital payments, ms Sitharaman said.

Speaking on the occasion, Shri Pankaj Chaudhary, Union Minister of State for Finance said that PMJDY is not just a scheme, but a transformation movement that has enabled the financial independence of many unbanked population and created a sense of financial security

The support of all stakeholders, banks, insurance companies and state governments,

With the support of all stakeholders, banks, insurance companies and state governments, we are moving towards a more financially inclusive society and PMJDY will always be remembered as a game changer for financial inclusion in the country. The Pradhan Mantri Jan Dhan Yojana not only serves as an important example of governance in mission mode but also shows what the government can achieve if it is committed to the welfare of the people, Chaudhary said.

PMJDY provides one basic bank account for every unbanked adult. There is no need to maintain any balance for this account and no charge is levied on this account either. In order to promote digital transactions in this account, inbuilt accident insurance cover of Rs 2 lakh along with free rupee debit card has also been provided. PMJDY account holders are eligible for overdraft of up to Rs 10,0 to compensate for emergencies

The last decade, the journey of PMJDY-led interventions has been implemented,

Over the last decade, the journey of PMJDY-led interventions has been implemented, bringing about both transformative and directional changes so that banks and financial institutions have been able to provide financial services to the last person in the ecosystem society – the poorest of the poor.

PMJDY accounts have not only helped in getting direct benefit transfers but have also served as a platform for hassle-free subsidies/payments made by the government to intended beneficiaries without any brokers, seamless transactions and saving savings. Not only this, they have also played an important role in providing life and accident insurance to lakhs of unorganized sector workers through the Jan Suraksha Yojana (Micro Insurance Scheme).

The Jan Dhan Aadhaar and Mobile (JAM) Trinity has proved to be a diversion-proof subsidy distribution system around PMJDY

The Jan Dhan Aadhaar and Mobile (JAM) Trinity has proved to be a diversion-proof subsidy distribution system around PMJDY. Under direct benefit transfer through JAM, the government has transferred subsidies and social benefits directly to the bank accounts of the poor.

The successful implementation of PMJDY has achieved many milestones in the last 10 years. The major aspects and achievements of PMJDY are presented below.

PMJDY accounts: Rs 53.13 crore (as on August 14'24)

PMJDY accounts: Rs 53.13 crore (as on August 14’24)

Total number of PMJDY accounts as on August 14: 53.13 crore; 55.6% (29.56 crore) jan dhan account holders are women and 66.6% (35.37 crore) jan dhan accounts are in rural and semi-urban areas.

Deposits under PMJDY account – Rs 2.31 lakh crore (as on August 14'24)

The total deposit balance under PMJDY account is Rs 2,31,236 crore. With the increase in accounts by 3.6 times (August’24/ August’15), the deposit amount has increased almost 15 times

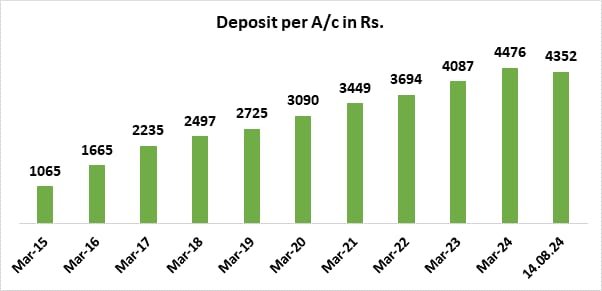

Average deposit amount per PMJDY account – Rs 4352 (as on August 14'24)

As on 14.08.2024, the average deposit amount per account is Rs.4,352. The amount of deposits per account has increased by four times as compared to August 15. The increase in the average deposit amount is another sign of the increased use of the account and the creation of saving habits among the account holders.

RuPay cards issued to PMJDY account holders: Rs 36.14 crore (as on August 14'24)

36.14 crore RuPay cards issued to PMJDY account holders: The number of RuPay cards and its usage has increased over time.

Over 36.06 crore RuPay debit cards under PMJDY, installation of 89.67 lakh POS/

With over 36.06 crore RuPay debit cards under PMJDY, installation of 89.67 lakh POS/MPOS machines and introduction of mobile based payment systems like UPI, the total number of digital transactions increased from 2,338 crore in FY 18-19 to 16,443 crore in FY 23-24. The number of UPI financial transactions increased from 535 crore in 2018-19 to 13,113 crore in 2023-24. Similarly, the total number of RuPay card transactions in PoS and e-commerce has increased from 67 crore in 2017-18 to 96.78 crore in 2023-24.

PmJDY’s success has highlighted the importance of digital public infrastructure such as Aadhaar for its mission-mode approach, regulatory support, public-private partnerships and biometric identification.

PmJDY's success has highlighted the importance of digital public infrastructure

PmJDY’s success has highlighted the importance of digital public infrastructure such as Aadhaar for its mission-mode approach, regulatory support, public-private partnerships and biometric identification.

PMJDY has enabled savings while providing access to loans to people without a formal financial history. The account holders can now show the saving method, which makes them eligible for loans from banks and financial institutions. The closest proxy is the restrictions under Mudra loans, which grew at a compound annual rate of 9.8% in the five years from FY2019 to FY24. This availability of loans is transformative as it empowers individuals to increase their incomes.

PmJDY being the world’s largest financial inclusion scheme, its transformative power and its digital innovations have revolutionized financial inclusion in India.read more