PAN 2.0 Project enables technology driven transformation of Taxpayer registration services and has significant benefits including:

jatinnews.com November 27, 2024 0

Single portal for all PAN/TAN related services to facilitate access for users.

An environment-friendly paperless process to reduce paperwork.

Pan will be provided free of cost along with processing time soon.

Personal and demographic data will be protected through enhanced security measures, including PAN data vaults.

A dedicated call center and helpdesk for solving user queries and problems.

Pan 2.0 aims to revolutionise the existing system by integrating all PAN/TAN services into an integrated portal, ensuring a seamless and paperless process. Free e-PAN service and simplified updates enhance the convenience of taxpayers. Take a detailed look at these key features:-

Integration of platforms: PAN-related services are now hosted on three different portals (e-filing portal, UTITSL portal and Protean e-Gov portal). In the PAN 2.0 project, all pan/TAN related services will be organized on a unified portal of the Income Tax Department. All end-to-end services related to PAN and TAN such as allotment, update, correction, online PAN validation (OPV), know your AO, link Aadhaar-PAN, check your PAN, request for e-PAN, request for reprint of PAN card etc. will be organized on the said portal.

Extensive use of technology for paperless processes: Complete the online paperless process instead of the existing mode.

Karad.

Changes for current PAN card holders

The old PAN card holders need not worry – the current PAN card holders will not have to apply for a new PAN under the upgraded system. The current valid PAN card under PAN 2.0 will remain fully functional if the holders do not request for updates or modifications. No new PAN card will be issued unless there is a specific request for update or correction.

QR code feature in PAN 2.0

Take a look at the QR code feature and what is changing under PAN 2.0:

THE QR code is not new; It has been part of the PAN card since 2017-18. Under PAN 2.0, it will be augmented with a dynamic QR code which will display state-of-the-art data from the PAN database.

Pan holders who lack QR code in the old card can apply for new cards having QR code under both the current PAN 1.0 system and upgraded PAN 2.0.

The QR code facilitates confirmation of validity, veracity of PAN details.

A dedication to checking the details.

Global Standards for Secure and Seamless Services

The PAN 2.0 Project adopts global standards to enhance taxpayer registration with seamless digital processes and strong data security. It ensures compliance with key ISO certifications for quality, security, and service management (e.g., ISO 27001, ISO 9001). The project streamlines PAN/TAN registration with simplified online processes, minimal documentation, and centralized databases, improving user experience while safeguarding data through robust security and international best practices.

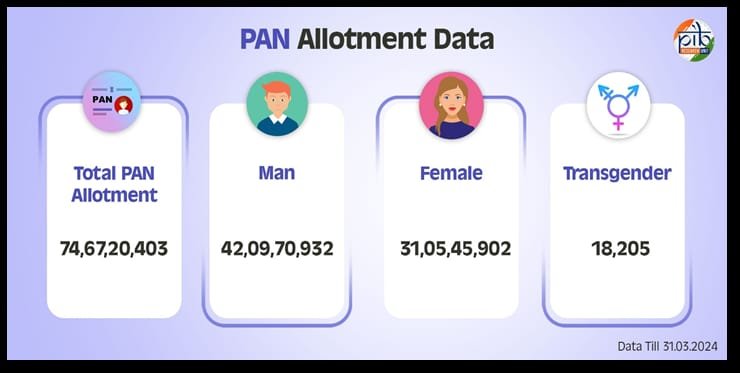

PAN Service in India

Pan has to be obtained –

• If every person has his total income or the total income of any other person in respect of which he is assessable in that year, he is more than the maximum amount which is not taxable.

• A charitable trust which is required to file returns under Section 139(4A)

• Every person who is carrying any business or profession whose total sales, turnover or total receipts are likely to exceed Five lakh rupees in any given year.

• Every person who wants to make specific financial transactions in which mention of PAN is mandatory. If the financial transactions made by them exceed Rs 2,50,00 in the financial year, then every non-individual resident person and their associated person will apply for PAN.

Fine for not having a PAN or placing more than one PAN:

Section 272B of the Income Tax Act imposes a penalty of Rs 10,00 on taxpayers who fail to comply with provisions related to PAN. This includes not getting a PAN if required,

Tan allocation[2]

TAN (Tax Deduction and Collection Account Number) is a 10-digit alphanumeric code issued by the Income Tax Department for entities responsible for TDS/TCS. It is mandatory to file returns, make payments and issue TDS/TCS certificates. Tan cannot be replaced with PAN except for certain provisions like Section 194-IA. Failure to receive or mention TAN can lead to penalties, emphasizing its important role in ensuring tax regulation and accurate reduction tracking.

The theory[ edit ]

The PAN 2.0 project is an important step towards modernising India’s tax system with digital processes, security and greater accessibility. By shifting directly to the delivery model and integrating global best practices, it promises a more streamlined and efficient experience for taxpayers, aligned with the government’s vision of a digital India. This move not only simplifies the service but also data protection and transparency. read more